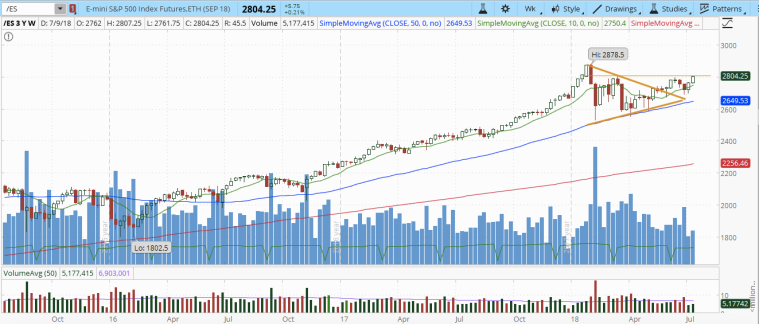

S&P 500 futures continue the uptrend and it is in a good position to challenge the next resistance at 2806 (horizontal orange line). Quarterly earnings started to release and it should continue to steer the direction of the market. Trader can take a more aggressive position once 2806 is protruded with high volume.

Crude oil futures slumped after forming doji on the previous week. It is still early to determine if bearish reversal is formed or a rest in the uptrend as 10 weekly SMA is still holding tight. The price tends to go sideway before the trend is resumed, hence, options trader who does not want to forecast the direction and sell iron condor at $75 level (Bear Call Spread at $75 & $76; premium ) and $63 level (Bull Put Spread at $63 & $62)

Gold futures dropped last week and hold tight at 200 weekly SMA. Option traders who initiated the position two weeks ago week should still be making unrealised profit if still holding on to the position even thought the direction of the price went against them. This is because the time decay works for the options seller. As for the traders who long gold futures at the price around 1256, with the stop loss at 1230 (Losing 26 pts) and target profit at 1350 (Making 96 pts), they should continue to hold the position without adjustment with the mindset of willing to accept the loss if 1230 stop loss is triggered.

Trader mindset #1 – Remember, we can lose a battle but win the war.

Hi, could you advise for e.g. on /CL for BCS & BPS your preferred DTE? Whats’ your view strike price differences vs DTE? Thank you in advance!…sam

LikeLike

Hi Sam, when I sell credit spread such as BCS & BPS, I will normally choose a shorter DTE, ranging 30-45days to take advantage on steeper time decaying; as for strike price differences, I will take 1 or 2 spread away to ensure it can be repaired easily if it goes against me; i will also ensure that I am comfortable with the max loss that if I am not repairing. Hope it helps and happy trading!

LikeLike