It has been awhile since my last post due to my work commitment overseas. While I am still closely following the market and trade, I couldn’t allocate much time to consolidate the thoughts and post it in my blog. Hence, I would exclude those few winning trades from reporting in live trades section. Continue reading “Performance & Review in Mar-Apr 2016 (Apr 16 Expiration)”

Category: My Trade

Performance in Feb-Mar 2016 (Mar 16 Expiration)

Today is Mar 2016 Monthly Equity Options Expiration Friday. My result as per below:-

Performance in Feb-Mar 2016 (Mar 16 Expiration)

Continue reading “Performance in Feb-Mar 2016 (Mar 16 Expiration)”

Real Deal – Mar 2016 #7 #8 #9 (Open WYNN, AMZN, LNKD)

Trade #7 – WYNN -> Captured credit $1.00. As long as WYNN does not trade above $90 on 15 Apr 2016, I will make $100.

Continue reading “Real Deal – Mar 2016 #7 #8 #9 (Open WYNN, AMZN, LNKD)”

Real Deal – Mar 2016 #4 (SPY – Closed Position – Turning a losing trade into a winner)

Original trade with two updates #1 & #2

The aggressive repair method paid off and I managed to turn a losing trade into a winning trade.

Real Deal – Mar 2016 #6 (WYNN – Closed Position – Turning a losing trade into a winner)

Original trade with two updates #1 & #2

The aggressive repair method paid off and I managed to turn a losing trade into a winning trade.

Real Deal – Feb 2016 #6 (WYNN – Bear Call Spread)

Feb 2016 #6 (WYNN – Bear Call Spread)

Placed an order (WYNN Bear Call Spread) yesterday and the order get filled while I was sleeping. SPY Bear Call Spread, 24 DTE and capture $1.92 ($192 per options contract) premium. Options detail as per the screenshot below. Continue reading “Real Deal – Feb 2016 #6 (WYNN – Bear Call Spread)”

Real Deal – Feb 2016 #5 (WMT – Close Position +52.1% in 4 months)

I intend to free up margin for other opportunity hence I close out WMT that I initiated last year. I bought WMT LEAPS and subsequently I sold 2 short term calls against it.

Continue reading “Real Deal – Feb 2016 #5 (WMT – Close Position +52.1% in 4 months)”

Real Deal – Feb 2016 #4 (SPY – Bear Call Spread)

Feb 2016 #4 (SPY – Bear Call Spread)

Placed an order (SPY Bear Call Spread) yesterday and the order get filled while I was sleeping. SPY Bear Call Spread, 29 DTE and capture $1.92 ($192 per options contract) premium. Options detail as per the screenshot below.

Continue reading “Real Deal – Feb 2016 #4 (SPY – Bear Call Spread)”

Real Deal – Feb 2016 #3 (XLE – Bear Call Spread)

Feb 2016 #3 (XLE – Bear Call Spread)

Enter XLE Bear Call Spread, 29 DTE and capture $0.82 ($82 per options contract) premium. Options detail as per the screenshot below.

Continue reading “Real Deal – Feb 2016 #3 (XLE – Bear Call Spread)”

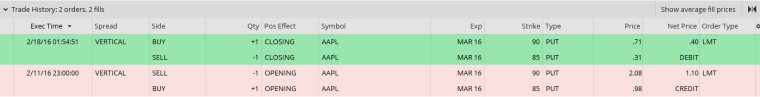

Real Deal – Feb 2016 #1 (AAPL – Bull Put Spread) – Update +17.95% return in 7 days

AAPL credit spread is closed with $0.70 premium captured ($70 per options contract)

Return On Margin = 0.70/(5-1.1) * 100% = 17.95% return in 7 days. Not a bad result!